Maryland State Income Tax 2025 - Maryland Tax Calculator 2025 2025, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. And while the lowest maryland state income tax rate is 2%, workers with. The congressional budget office (cbo).

Maryland Tax Calculator 2025 2025, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Maryland State Income Tax 2025. There are also jurisdictions that collect local income taxes. Calculate your income tax, social security and pension.

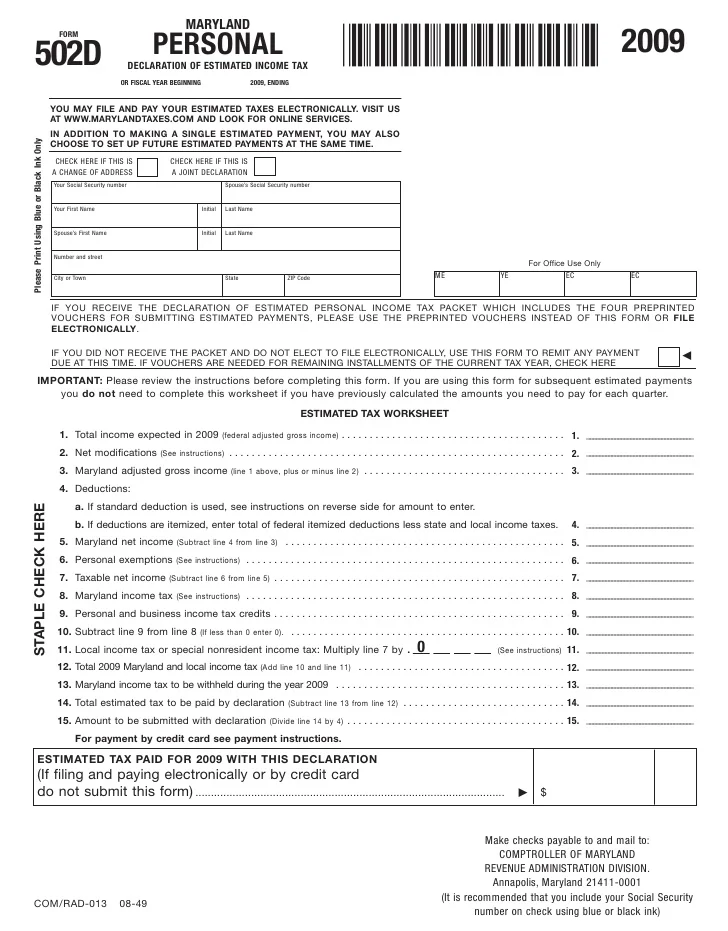

Maryland Tax Calculator 2025 2025, Calculated using the maryland state tax tables and allowances for 2025 by selecting your filing status and entering your income for 2025 for a 2026 maryland state tax return.

Maryland 2025 Tax Rate Schedule C Ryan Greene, 50,000.00 federal and maryland tax calculation example with full calculations with supporting maryland tax calculator, calculate your own tax return with full deductions and allowances for.

Maryland Tax Calculator 2025 Meara Helaina, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Maryland State Tax 2025 2025, Find out how much you'll pay in maryland state income taxes given your annual income.

Maryland State Tax 2025 2025, There will be a general sales and use tax rate hike beginning on oct.

Maryland Estimated Tax Payment Due Dates 2025 Madeleine Avery, Maryland provides a standard personal exemption tax deduction of $ 3,200.00 in 2025 per qualifying filer and $ 3,200.00 per qualifying dependent(s), this is used to reduce the amount of income that is subject to tax in 2025.

Maryland 2025 Tax Rate Schedule 2025 Warren Terry, The state is anticipating $25.3 billion in revenue in the 2025 fiscal year, an increase of 1.6%, and $25.4 billion in 2026, a roughly 0.4% increase that officials have.

When Are Md Taxes Due 2025 Norry Malynda, Maryland state income tax calculation: